Here, at The Market Ladder, we like to trade inverse and Leveraged ETFs to get the greatest trading flexibility, and amplification of results while using money management techniques to protect capital.

For the average investor, we show exactly what to trade, exactly how to properly buy, or get into, a trade, hold it for a number of days or weeks, and then how to properly sell, or exit, the trade.

There will be always be winners and losers but the key to is have bigger winners than losers, and repeat the process over and over.

Using only the Best ETFs with the following qualities:

- Higher daily dollar volumes.

- Lower spreads.

- Lower historical “Premiums” and “Discounts” to Net Asset Value.

These qualities all help to ensure the average investor will easily be able to get in and out of a trade at the best possible prices.

Why kinds of patterns does The Market Ladder seek?

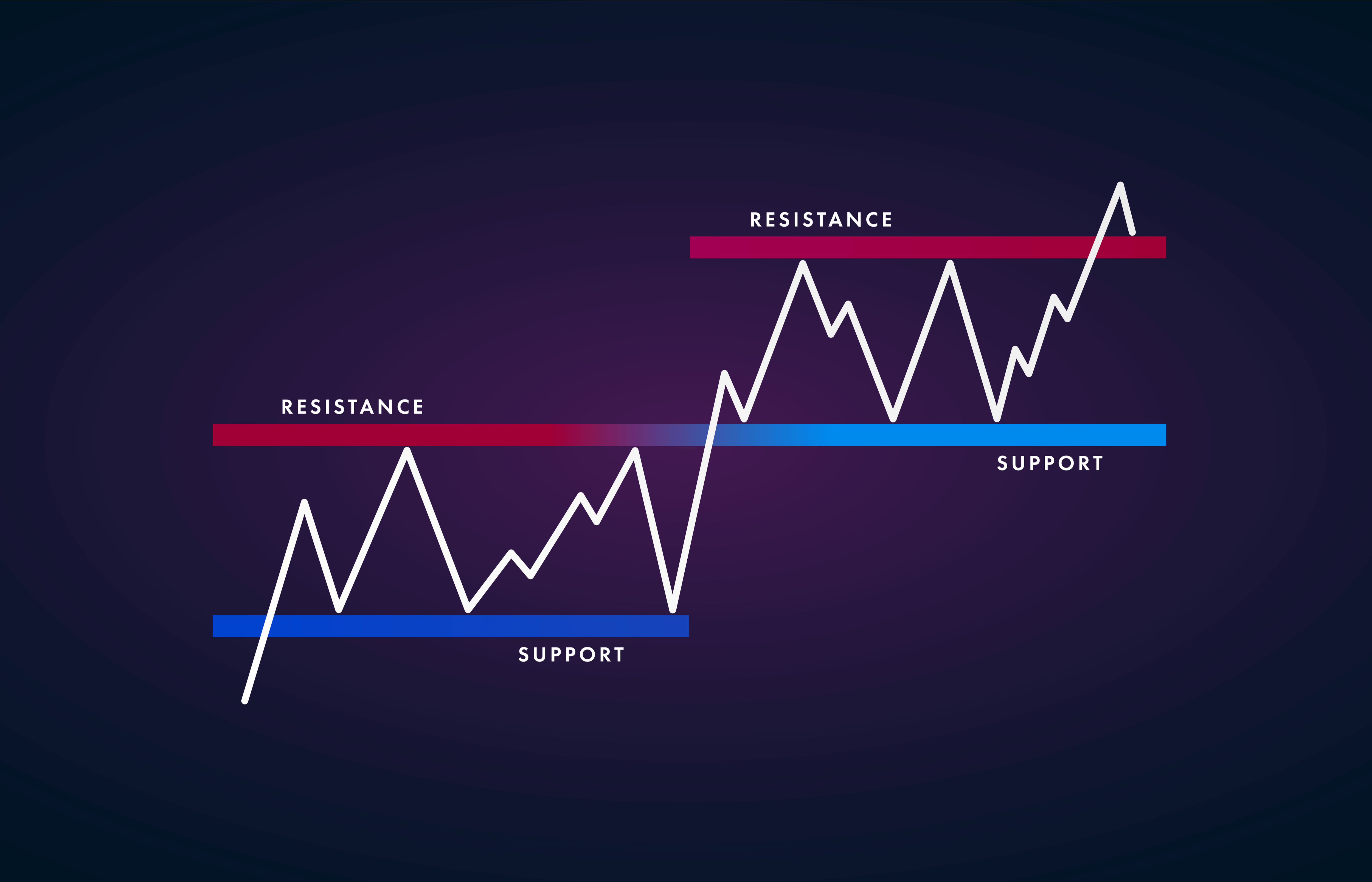

One of the trading patterns we look for is to buy in a "Support Zone." Notice on the adjacent picture, how price is sort of trapped on the lower end by "Support" zones and the upper end by "Resistance" zones. So buying close to this Support Zone, and selling near the top at the "Resistance" zone can work out to be a nice profitable trade.

Other key patterns traded are "Pullbacks, Overbought, and Oversold” ...... But no matter the pattern, we focus on potential "pivot points" in price action. So, the expected win rate may just 50%, but the trade will always show much more potential to the upside than downside, usually 2 times or 3 times as much. This is the one of the keys to successful swing trading.

What are the costs of Swing Trading with ETFs?

- Just like with trading stocks there may be Trading fees / Commissions. (Many online brokers today offer commision free trading, so make sure your broker fee is acceptably low, if not free.)

- **And just like stocks, trading ETFs will incur Taxes. Because we hold these instruments for less than one year, they are considered “short term gains,” and taxed as ordinary income. (However, If you are able to trade these instruments within a retirement account, your gains will not be taxed as long your money remains in your retirement account.**)

- Because ETFs are managed, they come with higher expense fees. The Leveraged and Inverse ETFs will have expense fees of about 1%, per year of holding. (The good news is that these fees are relatively very small in comparison to the typical price movements of the ETFs over a few days or weeks, so getting into a good trade is still the main key.)

What are the potential pitfalls of Swing Trading with ETFs?

The Market Ladder looks for only the best ETFs to trade, looking for the following qualities:

- With any investment, the bigger the price swings the bigger the risk, and this is certainly true with the leveraged products (where 2 times, or 3 times the "normal daily price" swings are typical!) With these leveraged products you can make bigger gains quickly, and bigger losses quickly as well.

- Holding ETFs carries risk, and just like stocks, the ETFs may fall in value quickly. When this happens, it may be hard to get out of the trade at a decent price, even with a “Stop Loss.” (Don't assume a "stop loss" is a guaranteed "stop out price," as it will work most of the time as intended, but not always.)

- Because leveraged products are designed to achieve 2 times, or 3 times, the daily returns of their tracking target, holding for longer time frames, (i.e. several weeks ) in volatile markets will usually show their gains to poorly track the original investment, and usually to the downside. This has been named "time decay" of leveraged etfs, and is a mathematical irregularity of the daily matching as it gets multiplied over longer periods of times.

- ETFs can fall off their tracking products' worth, known as "Net Asset Value," or "NAV," usually in relatively small amounts. During periods of high market volatility, these "tracking errors" can become significant, and it's best to wait for things to calm down. (This is another reason The Market Ladder will sit out the most volatile market periods when possible.)

What are Unsettled Funds?

Trading today is so very quick with just a click of a button, and an almost immediate transaction occurs, but the money that transfers from the sale of an ETF (or stock) to your account is not so fast. After an ETF(or stock) is sold it takes 2-3 days for the funds to come into the account. Most brokerages will allow you to buy another ETF on these “unsettled funds” as long as you do not sell that ETF before the original money “settles.” If the second ETF is then sold too quickly, you will get a “Good Faith Violation.” Get more than 3 of these violations in a 12 month period, and your account will be restricted from buying unless you have “settled” funds. Just be aware of this, so you can always have the funds to take the trade you want, and speak to your broker if you have any questions as to “Settled Funds.”

What are tips to getting the most of Swing Trading with ETFs?

- A new member may be tempted to jump into all current trades, but this is a bad idea since any trade advantage dissipates with time. New trades are often posted regularly, and it's always a better bet to take the new trades.

- A recommended trading size would be about 15% of your portofolio, at this size you can get a good bump up in your portfolio with a winning trade, but should not take too much of a hit on a losing trade. (Don't put more than 20% of your portfolio into a trade as this would be too much concentrated risk.)

- If you are able to make these trades within a retirement account, that's best, because you won't be taxed on the gains as long as they remain in the retirement account.

- Pay attention to the notes on every trade, as they will contain important information.

- Check The Ladder's Post daily for important updates to the trading activity, including reminders to set your profit and loss stops.

First time Subscribers can take a 30 day Free Trial to see if The Market Ladder might help you with your trading goals. -----> Join Now

** The Market Ladder is not an Investment Advisor or professional Tax Advisor. If you have any questions as to the appropriateness of the ETFs, or trading such in your investment account, please seek professional advice from your Tax Attorney or Investment Advisor.